ny estate tax exemption 2022

New York Estate Tax Exemption. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount.

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Up to 25 cash back The New York Estate Tax Cliff By contrast New York taxes the entire value of an estate that exceeds the exemption by more than 105.

. New York Estate Tax. The New York estate taxthreshold is 592 million in 2021 and 611 million in 2022. You may need to report this information on your 2021 federal income tax return.

The estate tax rate is based on the value of the decedents entire taxable estate. In 2022 the New York estate tax exemption is 6110000 up from 593mm in 2021. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

For people who pass away in 2022 the. The amount of the estate tax exemption for 2022. This means that a New Yorker passing away with more than the exemption amount or.

This is the amount that a person can pass on to heirs at his or her time of death without being obligated to pay New York state estate taxes. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service. 16 rows What is the current exemption from New York estate tax again.

Of all the states Connecticut has the highest exemption amount of 91 million. The current New York. As of the date of this article the.

In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. Only a small minority of families will have to pay estate taxes to the federal. New york state residents the estate of an individual who was a nys resident at.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The New York estate tax exemption equivalent increased from 593 million to 611 million effective January 1 2022 but continues to be phased out for New York taxable estates valued. Ad From Fisher Investments 40 years managing money and helping thousands of families.

Provided a persons taxable estate. Despite the large Federal Estate Tax exclusion amount New York States estate tax exemption for 2021 is 593 million. Trusts and Estate Tax Rates of 2022.

The exclusion was 585 million last year and it has been increased to 593 million in 2021 but there is a unique twist in New York. New York estate tax update for 2022. If the value of the estate is more than five percent of the.

In 2022 the New York estate tax exemption is 6110000 up from 593mm in 2021. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount.

The connecticut state gift estate tax exemption has increased from 71 million in 2021 to 91 million in 2022. In 2022 the law assesses no taxes on an individual taxable estate of less than 12000000. The New York States estate tax exemption for 2022 is 6110000 million.

That number will keep going up annually with inflation. New York is one of the states that administers their own NY estate tax and has a relatively low NY estate tax exemption amount. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

Even if a deceaseds estate is not large enough. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. New Yorks estate tax exemption is 5930000 for 2022 up from 5850000 for 2021.

New York State does not recognize portability so unlike federal law which enables a surviving spouse to make use.

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Estate Taxes Under Biden Administration May See Changes

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

What Is A Homestead Exemption And How Does It Work Lendingtree

New Estate And Gift Tax Laws For 2022 Youtube

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Key 2020 Wealth Transfer Tax Numbers Murtha Cullina Jdsupra

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

New York S Death Tax The Case For Killing It Empire Center For Public Policy

It May Be Time To Start Worrying About The Estate Tax The New York Times

2022 Updates To Estate And Gift Taxes Burner Law Group

New York S Death Tax The Case For Killing It Empire Center For Public Policy

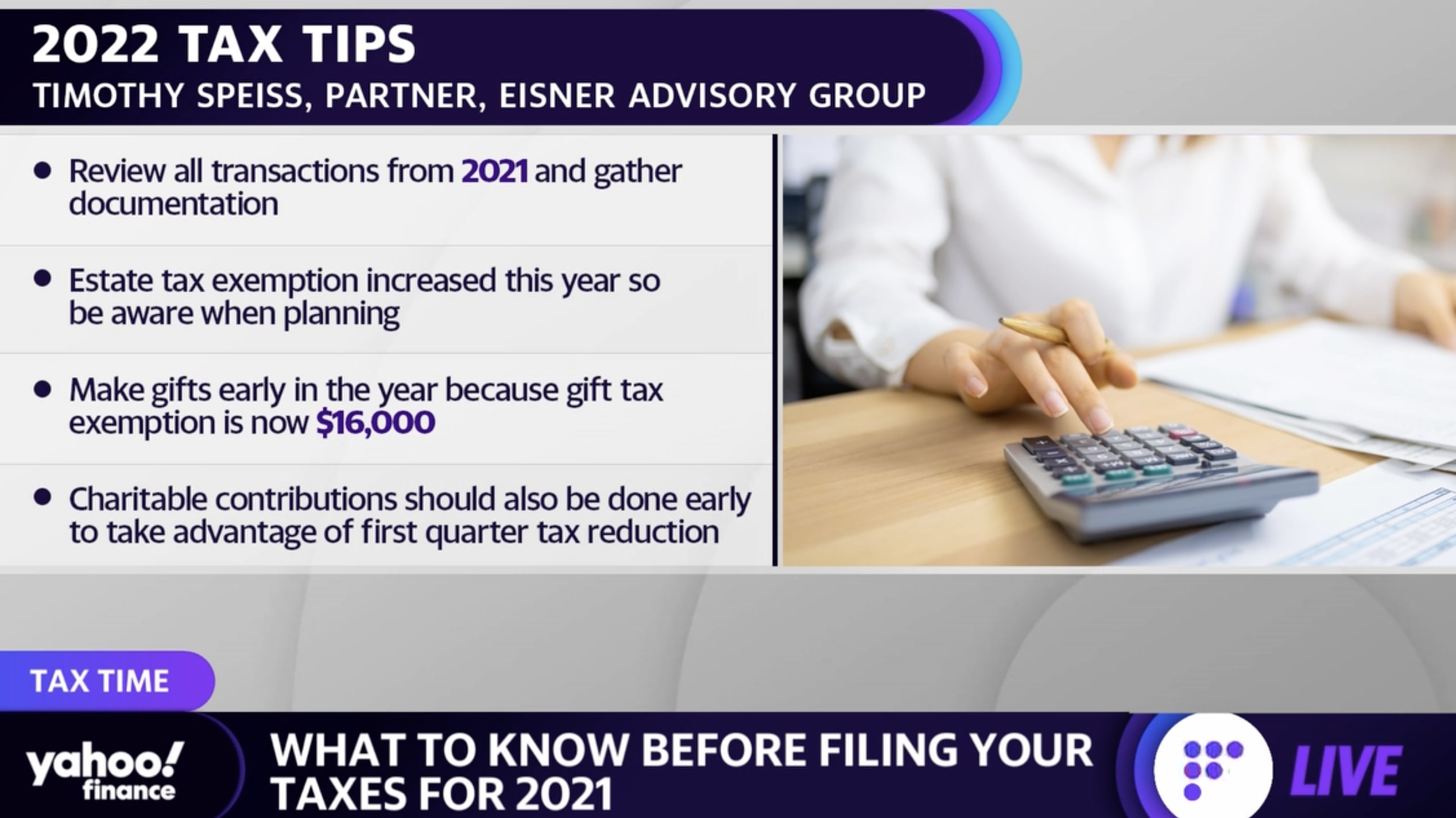

Taxes 7 Tips To Prepare For The 2022 Tax Season

Lifetime Qtipable Trusts For Gift Estate Tax Exemption Planning New York Law Journal