what qualifies for home improvement tax credit

The Inflation Reduction Act expands a homeowner efficiency tax credit called the Energy Efficient Home Improvement Credit. This credit is worth.

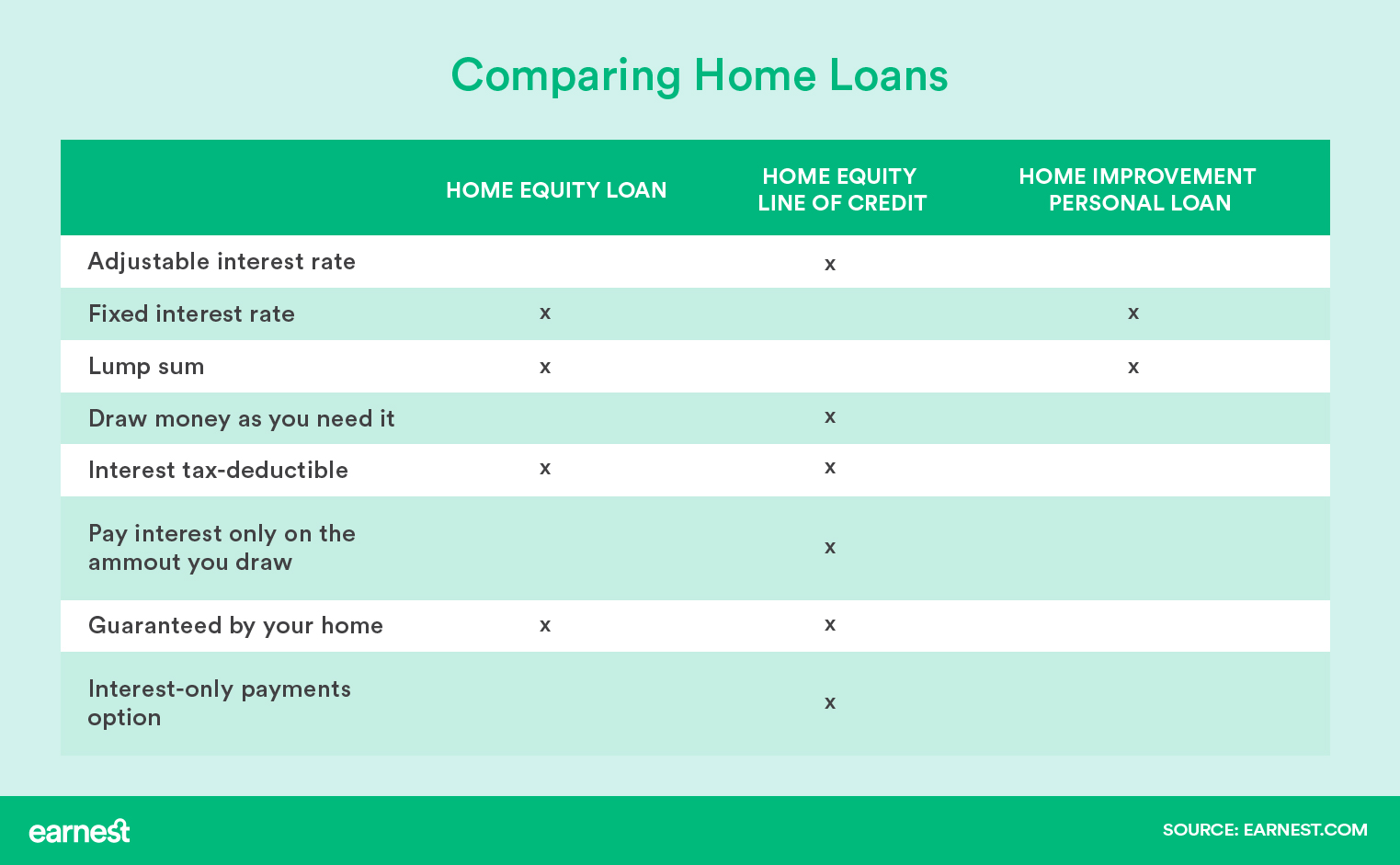

Home Equity Loan Vs Line Of Credit Vs Home Improvement Loan Earnest

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property.

. The deductions must be considered reasonable and must have a practical use. The Energy Efficient Home Improvement Credit is worth 30 of the total cost of the. Eligible expenses include the cost of labour and professional services building materials fixtures equipment.

Energy Efficient Home Improvement credit emerged as a result of these modifications. Beginning January 1 2023 there will be a federal tax credit for exterior windows and doors. The Residential Clean Energy Credit under the.

If you can manage to spread your qualifying home improvement projects throughout the credits current upgraded availability through December 31 2032 you could. Adding adequate insulation is one of the most cost-effective home improvements that you can do. Eligible expenses include the cost of labour and professional services building materials fixtures equipment.

These are all improvements that can be deducted through the medical expense deduction. Some of the energy-efficient improvements at your home are Installing an HVAC system. The IRAs Energy Efficient Home Improvement Credit renames a nonbusiness energy property tax credit that expired at the end of 2021 and extends it through 2032.

Your cost basis would be 250000 assuming you didnt make any other improvements that didnt result in claiming a residential energy tax credit. Using asphalt roofing qualifies you for the tax credit while you observe other measures and qualifications. Energy-efficient improvements at home will qualify homeowners for Federal tax credit benefits.

The 30 tax credit applies to both labor and installation costs. The energy efficient home improvement credit will however be worth 30 of the costs of all permissible home renovations. You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

You would have a. However starting in 2023 the credit will be equal to 30 of the costs for all eligible home improvements. 10 of the cost up to 500.

The Internal Revenue Code qualifies certain types of insulation exterior doors skylights energy efficient windows and many other improvements for this energy credit. This covers up to 30 of the cost of energy. It can be in a traditional form or a modern form.

The 30 tax credit applies to both labor and installation costs. It involves using solar power home battery storage and other properties related to green energy. The credit is revived for the 2022 tax year and the old rules apply.

Tax Deductible Home Improvements For 2022 Budget Dumpster

Are Home Improvement Loans Tax Deductible Not Always Supermoney

Federal Tax Deductions For Home Renovation Turbotax Tax Tips Videos

Tax Deductible Home Improvements For 2022 Budget Dumpster

Taxes The Ascent By Motley Fool Tax Credits Renovations Tax

Tax Deductible Home Improvements For 2022 Budget Dumpster

What Is A Capital Improvement Rocket Mortgage

Are My Colorado Home Energy Efficiency Improvements Tax Deductible Www Erc Co Org

What Home Improvements Are Tax Deductible 2022 2023

:max_bytes(150000):strip_icc()/GettyImages-551425607-f1c354ae6d184b89a161e714d2ef659b.jpg)

Are Home Improvements Tax Deductible

What Home Improvements Are Tax Deductible 2022 2023

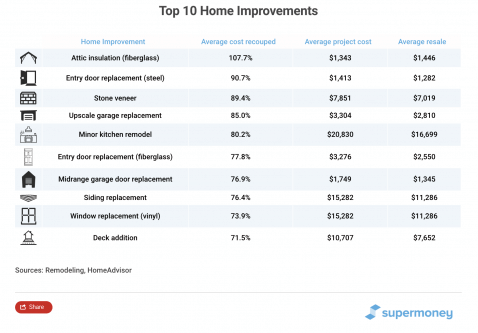

Are Home Improvement Loans Tax Deductible Not Always Supermoney

Income Tax Deductions For Energy Savings

Home Insulation Are There Energy Efficient Tax Credits Attainable Home

Tax Credits On Windows Doors Energy Star Next Door Window

Energy Efficient Home Improvement Credit Tax Insights Podcast Youtube

4 Home Improvement Projects That Are Potentially Tax Deductible

Green Energy Tax Credits For Home Improvements And Vehicles The Official Blog Of Taxslayer

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions